In the following blog post, I made a financial literacy matrix based on my perspective of financial literacy competences. The objective of the matrix is to better give people an overview on what’s out there and how to navigate an increasingly complex investing environment. It’s definitely not complete and people should be aware that you need to invest in your knowledge and mindset to acquire the core competences.

The CashFlow Quadrant

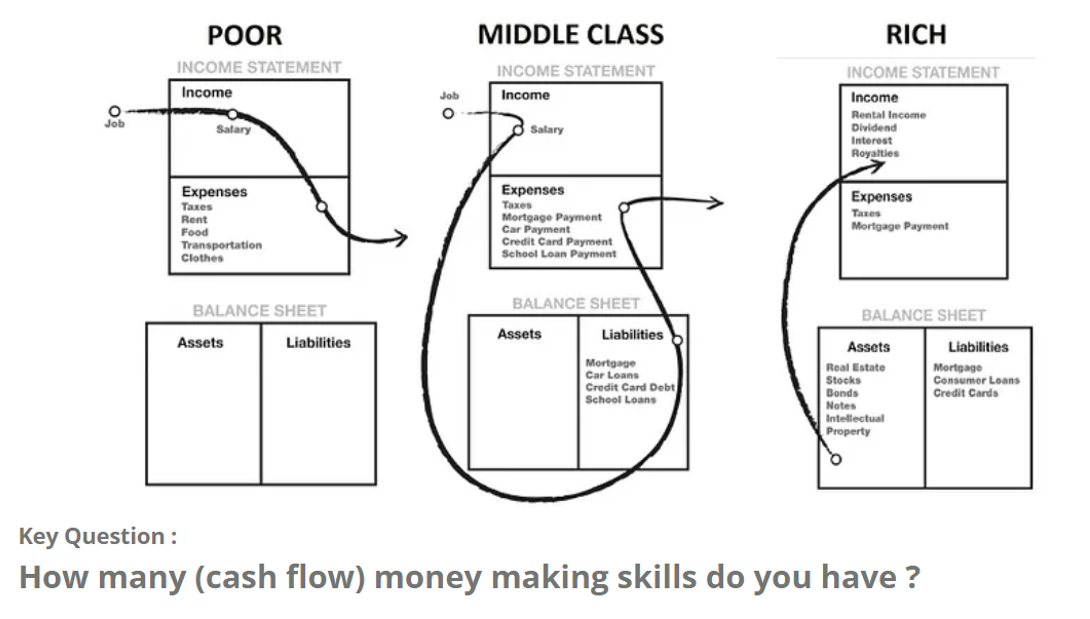

It all starts with how you master the skills of cash flow in the first place. This is perfectly described in the book of Robert Kiyosaki. If you don’t develop investing or cash flow generation skills, you will stay stuck in the paycheck to paycheck syndrome.

The Financial Literacy Matrix

The above cash flow statements can also be summarized in the following overview. Levels 0 and level 1 are people who hardly know the difference between assets and liabilities. You make a salary, pay your bills and/or mortgage and save some money for your future or big expenses.

Level 2 and level 3 are people who put aside money for investments. They look to invest their money in wealth preservation or growth assets. Level 4 and level 5 are people who know how financial systems and products differ. They know different strategies how to multiply money with different strategies. It doesn’t have to be trading. It can be real estate, their own business,.. They know how to invest in assets that pay dividends.

The Smart Investor Competences

The smart investor develops and masters the following skills. He’s capable of doing the correct analysis. If he’s a value or growth investor, he’s able to execute fundamental analysis. If he’s a FX trader, he’s able to understand the macro-environment of the central banks. Technical analysis provides the additional skills where to enter and exit.

Investors or traders who master the skills to use leverage in a risk controlled manner, own the knowledge to generate extra cash flow to make extra investments. Warren Buffett will write put options to collect premium. A British hedge fund manager showed me how he uses leveraged products and CFDs to create extra cash flow in a risk controlled way. Using leverage in a risk controlled way separates the Level ⅔ from the level ⅘ investors or traders in whatever asset you use.

Assess your Financial Literacy Competences

Below you can find an overview of how I assess financial literacy. Level 0 are people who never got the opportunity to learn financial literacy or didn’t see the need for it. In Level 1, you can find the majority of people. Hopefully they have developed an emergency fund and save money in a savings account. Some invest in a house and pay off a mortgage for the next 20 years.

In Level 2 and Level 3, you find the people who invest in assets. It could be assets that appreciate in value or pay dividends.In Level 3 people own the skills on how to use different financial products in different asset classes.

In Level 4 and Level 5, we have the smart investor and trader. They know how to use leverage and master risk as best. In Level 5, I see A.I and automation doing its introduction.

Assess your Trader Competences

Below you can find an overview of trader competences. I read a lot of financial journalists (Level ⅔) criticizing traders. What separates traders from investors are the risk and leverage skills.

Level 0 are the people who don’t invest in the skills and/or play the gambling lottery instead. Level 1 and 2 are people who understand how to trade different markets (stocks, Currencies, Commodities, Indices) with different financial products. They understand how to use leverage and risk in a controlled manner. I compare this skill as golf players as they master different competences in ONE CASH FLOW generation skill.

Level 3 are people who master options trading. You can use options trading in many different ways but the most used ones are to generate extra cash flow or to protect assets value. I compare this with e-cart driving. Risk can be controlled in an effective way. In Level 4, you can find futures traders. I compare it with F1 driving as risk control is the key competence you need to execute this properly with high leverage. In level 5, you can find algorithmic trading and investing. More and more legit companies in different countries pop up to allow investors to diversify their portfolios. Make sure you do your own due diligence before making any investment. I compare it with robot taxis. I am personally following closely how this industry develops and creating my own shortlist for the future.

Assess your Investor Competences

Below you can find an overview of the different levels of investing skills. The objective is to invest to preserve your wealth and hopefully your assets grow in value when you retire.Let’s review this matrix.

Level 0 are the least knowledgeable investors. They outsource their investing portfolio, pay a substantial fee for this service as they don’t have the time or mindset to learn this. They hope the private banking service will preserve their wealth. Retail investors with limited knowledge also go to retail banks where mutual funds are presented with the same fee structure. Be aware that the performance of the private banker or mutual fund needs to outperform the fee structure over time to keep at least the same amount of what you invested.

Level 1 are investors who want to keep it simple. They invest in holdings or index funds. They hope their investments are higher in value by the time they want to retire. Here the focus is on the lowest cost structure. Level 2 are more knowledgeable investors who know how to assess different ETFs in different asset classes. They also know how to invest in stocks.

Level 3 investors are dividend (growth) investors or real estate investors. They focus on income investing. Here more knowledge and work is required if you are a DIY investor. Level 4 are investors who know how to invest in commodities and preferred shares. Level 5 are private equity investors. This matrix doesn’t say what’s good or bad for you as a retail investor. This depends on your financial objectives, attitude towards risk and return and personal (limited) beliefs.

Personally I compare competences in the stock market as competences in playing soccer. You will find soccer coaches, soccer analysts, soccer teams, … Many opinions about what’s best for you to invest in. Some will say invest in a world soccer team, others will say ‘hire a coach’,…

Final Words

Personally, I consider myself a Level 4.3.3 I use my cash flow strategies to generate income for my investments. Over the next upcoming 5 years, we will develop our skills and more software to a level 4.4.5 where automation will become more important.

Do you need to be at this level to be a successful investor? Not really. Make sure you develop the skills you consider important to achieve your financial goals. Whether it’s wealth preservation/growth or cash generation skills. I have always networked and learned from hedge fund managers, traders and investors OUTSIDE of Belgium who execute the skills I also wanted to own. I am simply a product of my own decisions.

Once you understand the above financial literacy matrix, you can quickly assess somebody’s competences. If you are an index investor and nothing else, you have level 2.1.0. You invest money from salary or other investments (rental income) in an index fund. You don’t know how to use leverage or manage risk. If you are a financial journalist writing about the stock markets, giving speeches for retail banks, or writing books, you are most likely level 2.2.0 or 2.2.3. I still have to meet the first financial journalist who executes him/herself trading for cash flow purposes and knows how to manage leverage and risk properly.

Wealth managers dependent on the country will have level ⅔ or level 4 competences. Hedge fund managers are in most cases level 4 or level 5.

If you are a stock, FX, indices or commodities trader, you must master the skills to manage leverage and risk properly. You are level 4.2.3 You can risk your own money or you can use professional trading companies’ money. At least you understand the correlation between different asset classes and developed an edge in the financial markets.

The additional advantage this matrix offers me, is to quickly assess when somebody writes/talks about things he probably has never done himself. Start investing in your own knowledge.

Thanks for following us on Twitter and Facebook and reading this blog post. If you want to follow us daily, join our Telegram market news channel. We end with a quote as always.